Book Report: 'Red Carpet' by Erich Schwartzel

Three quick takeaways from Erich Schwartzel's 'Red Carpet: Hollywood, China, and the Global Battle for Cultural Supremacy'

So, what’s this all about?

During my time in strategy consulting, I had the opportunity to work on an international market assessment for a Global Media & Entertainment company, specifically focused on understanding consumer readiness for streaming via Connected TV. Our team’s remit was to compare and contrast consumer behaviors between the US and representative Ex-US countries in order to identify international candidates best suited for potential expansion. As we worked with the client to select target geographies to focus our analysis on, I was surprised that one of the largest international markets was left off of our list. Perplexed, I raised my concerns to one of our team leads. As it turned out, the omission of China was deliberate.

Given my role in the industry and interest in business strategies, a friend recommended Erich Schwartzel’s ‘Red Carpet’ early on in 2022; their recommendation was spot on. I devoured the book in short order. In it, Schwartzel takes on the weighty task of laying out the development of Hollywood’s relationship with China over the years, and for me personally, helped to shine some light on why China is considered such a unique market from the eyes of American Media companies, especially as it pertains to international growth and expansion strategies.

In short, the book lays out China’s entrance into the global Media & Entertainment space, starting with Chinese ambassadors’ deliberate trips to Los Angeles to learn from the best in the world, Hollywood execs, and leading to a long and tumultuous relationship in the time that followed.

For today, I want to focus on a few key takeaways that I found to be particularly interesting but would be remiss not to plug what was my favorite book of 2022 on the business of Media & Entertainment; buy the full book from Amazon here or find a great overview from the New York Times here.

The three key areas which I want to focus on are as follows:

The Pro’s & Con’s of Distribution in China

A Case Study on how One Company Successfully Played Ball (naturally, Disney)

What’s in Store for the Global Entertainment Stage, and the Cultural Implications

#1 - The Pro’s & Con’s of Distribution in China

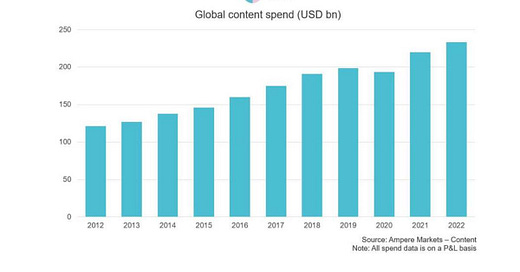

It is no secret that the cost of premium content has skyrocketed in recent years. In its recent earnings call, Disney confirmed content spend of $30B+ USD in fiscal 2022 with plans to maintain or even increase spending in fiscal 2023. This is in line with what we are seeing across other major US studios, as competition increases to win over consumers.

At a high level (and varying company by company), this content spend can be thought of in three main buckets: Original Content (TV + movies the company is producing), Acquired Content (TV + movies the company is purchasing or “renting”), and Sports Rights. Today, much of this spending across all three buckets is fueled by an intense and competitive digital landscape and is geared towards enticing customers to subscribe to Direct-to-Consumer services. There is much debate about how to best select optimal distribution channels; however, theatrical remains an important vector across the board for monetizing that spend accordingly.

With rising costs and competition comes a need for increased revenues. Enter China. Prior to the 1990’s, China was somewhat of a white whale for many global businesses, especially in the Media & Entertainment industry; though the large population represented sizable growth opportunities, centralized control over the economy proved difficult to penetrate. That was until China realized that it too could benefit from this partnership in Hollywood, notably in its ability to tell compelling stories with global appeal.

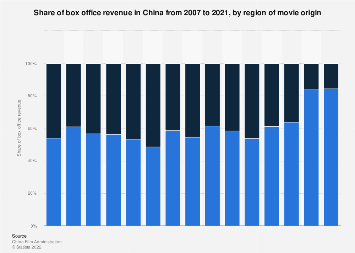

Once this nexus was crossed, it quickly proved mutually beneficial - at least initially - with international box office sales rising and significant Chinese investment in the industry. However, Hollywood executives quickly became acutely aware that censorship standards differed greatly between their country and China and soon were confronted decisions between telling the stories they wanted to tell and the stories that would satisfy Chinese censorship requirements.

This coupled with the Chinese Media & Entertainment industry’s growing propensity for telling locally relevant stories resulted in somewhat of a reversal, as seen in the chart above, with Chinese box office revenues returning to predominantly domestic productions (~85%) vs closer to an even split in preceding years.

Today, due to the increased censorship protocols and improved domestic offerings, there are few American players who have found sustainable success in China; one of which is Disney.

#2 - How One Company Successfully Played Ball

Disclaimer: I am currently working at Disney, and even before I started there had been a big fan of their strategy since I began following the company. That said, one company Schwartzel calls to the reader’s attention is Disney, due to the reach and success it was able to develop over time in China.

Let’s start by acknowledging some of the obvious. Disney is proprietor to many global brands and characters and is no stranger to international expansion. In fact, Shwartzel points out that the company even had a proven “formula” for international growth which he lays out in his book.

In short, Disney historically took the following steps to build up its presence and establish its famous “IP flywheel” in new markets:

Movies & TV Shows: Launch Disney channel programming within the local TV broadcast system, introducing children in the market to Disney’s beloved stories and characters.

Merchandising: Build on content affinities with Disney-branded merchandise, perhaps being sold through new local retail destinations.

Real Life Experiences: Give local Disney fans the chance to bring their favorite movies and characters to life by standing up theme parks, far closer to home than those in Orlando or Los Angeles.

This strategy proved successful first in Japan with the Tokyo Disney Resort in 1983 and then with Disneyland Paris in 1992. For many years, previous Disney CEO Michael Eisner had tried to implement a similar strategy in China but had come to headwinds with Step #1 of his plan; the Chinese government did not want Disney-branded channels as part of their local TV broadcasting system. For Disney, this lack of distribution meant no ability to build brand affinity with Chinese residents and materially impacted the business case for investing to build out retail or theme park presences in the country.

However, where I think this gets really interesting is in how Disney proceeds. Posed with the challenge of how to introduce Chinese children to Disney brands and characters without being able to do so via TV or movies, Schwartzel argues (though some Disney executives disagree) that the company opted for an alternative method: Disney English.

Founded in 2008 under current CEO Bob Iger, Disney English capitalized on increasing globalization and the desire among the Chinese to teach their children the English language. The learning centers provided an immersive English-language curriculum to Chinese school-age children and in doing so introduced them to beloved Disney characters who were infused into both classroom décor and the actual lessons being taught. For example, students may learn vocabulary related to the winter season from characters like Elsa, the princess from Disney’s ‘Frozen’. Over time, this program expanded to ~25 locations across China - and not too long after, Disney’s Shanghai Resort opened in 2016.

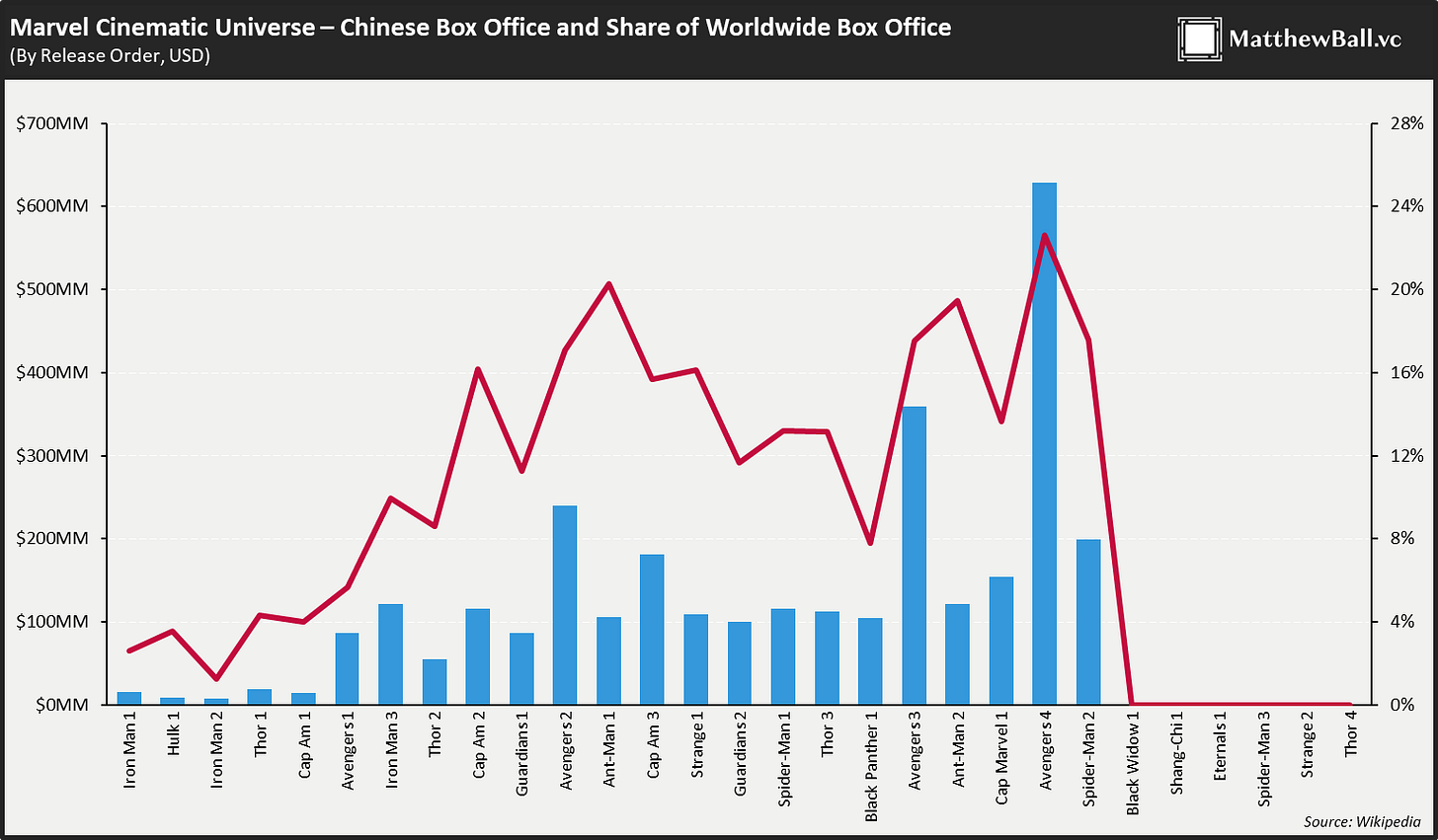

Disney English aside, Bob Iger’s inorganic growth strategy for Disney also improved the company’s foothold in the Chinese market - purchasing brands like Marvel and 21st Century Fox, whose titles (e.g., Avatar, Avengers: End Game) resonated with Chinese and American audiences alike.

As seen in the analysis from Matthew Ball above, Marvel releases benefited significantly from the Chinese box office, at times getting 20%+ of total global revenues from this single market. This proved crucial given the expenses necessary to produce these mass-market superhero films, often garnering production budgets in excess of $150-200M. After seeing significant success in its own theatres (2019’s ‘Avengers: Endgame’ was the 4th highest grossing film in China), China abruptly froze domestic distribution of Marvel movies in late 2021 - blocking the release of ‘Shang-Chi and the Legend of the Ten Rings’, a Marvel movie led by an Asian superhero and taking place in East Asia. For Disney, this could be a sign of shifting tides within the Chinese market; however, the company’s marquee ‘Avatar’ sequel was approved for distribution in Chinese theatres for its December 2022 release, a sign that this blockade may not be as absolute as it initially seemed.

#3 - What’s in Store for the Global Entertainment Stage, and the Cultural Implications

So far, we have mainly focused on the upside of the Chinese market for American Media & Entertainment companies, namely, previously untapped revenue. However, Schwartzel’s argument for China’s interest and upside is interesting. Early on in the book, Shwartzel provides the reader with a comment from Mao Zedong that is intended to shine some light on China’s rationale for investing in the industry:

There is no such thing as art for art’s sake.

It was precisely for this reason that Mao had previously banned the importation of Hollywood’s products, a concern about the cultural ramifications these Western films may have on the Chinese population. However, subsequent leaders soon realized the potential importance of cultural levers (like TV & Film) in achieving the country’s goals of modernization and improved global perception. In tandem with national initiatives including the Four Modernizations and later on the Belt & Road Initiative, investment in a strong “Hollywood-like” domestic Media & Entertainment industry could be key in realizing those goals.

One particularly salient example is laid out in the book and pertains to China’s perception in Africa. Schwartzel plants the reader in a rural African village, but one key detail sticks out: large orange satellites planted on top of many of the small local homes. Inside these homes, groups may be huddled around TV sets watching national news, local programming, or, perhaps, a dubbed Chinese Kung Fu movie.

As part of Chinese President Xi Jinping’s ‘10,000 Villages Project’, over ten million subscribers across thirty African countries (CNN) receive premium local and international programming via Chinese telecom equipment vendor StarTimes. Not only that, but China has also made strides to improve local infrastructure (e.g., train stations) across rural villages to better connect them with larger African cities and the global trade economy.

The result? China is uplifting and empowering local African villages like never before, and in doing so, enhancing its local perception among these people. In conversations with locals, Schwartzel tests this theory by asking for thoughts on the improvements made by the Chinese in recent years relative to similar philanthropic efforts made by other countries. The contrast is clear in demonstrating the efficacy of this project and resulting perception shift. One interviewee, a Kenyan official, put it bluntly:

People don’t eat freedom.

Wrapping Up

Perhaps the thing I most enjoyed about ‘Red Carpet’ was that it left me thinking. Yes, the book provided a helpful and comprehensive overview of the American Media & Entertainment industry’s relationship with China, but it also begged questions about the cultural power of story-telling and the direction of how this power might shift globally over time. Lots of questions left to answer!

Again, I would highly recommend reading the book in full for the whole story, but if you enjoyed my musings, there are more to come!

I am targeting a weekly write-up on the latest happenings across the Media, Entertainment, & Sports industries - as well as plugs for great articles, essays, podcasts, and books like this one. Stay tuned, and please subscribe below for all the latest and greatest. Until next time!